Western Circle Group

We are committed to offering individuals in the UK immediate access to funds for handling unforeseen expenses and temporary emergencies.

We Help People- With Money

We utilize the world’s most advanced technologies to help people handle unexpected situations with instant money. Money is our tool, and the desire to help is our mission.

The cost of living in the UK is at an all-time high. Even with a solid income, many people and families struggle to save money for unexpected situations.

When your car breaks down, your kids need things for school, or your dentist sends you a hefty bill, you need quick and affordable access to money from a trusted source to fix the problem.

Western Circle Group is that trusted brand you can rely on when you face money challenges in the UK.

Why Have Over Half a Million People Chosen to Work With Us?

Our financial products and brands do more than just lend money. They help people handle unexpected emergencies by providing quick access to funds, without having to deal with slow banks, provide excessive paperwork, or have a perfect credit score.

We strive to make borrowing money safe, easy, and affordable. This allows you to focus on resolving your issue with peace of mind and repay us once the emergency is over. People choose us because they know we are dependable. Since 2014, our friendly team has been available via email, calls, SMS, WhatsApp, and chat. We take pride in what we do.

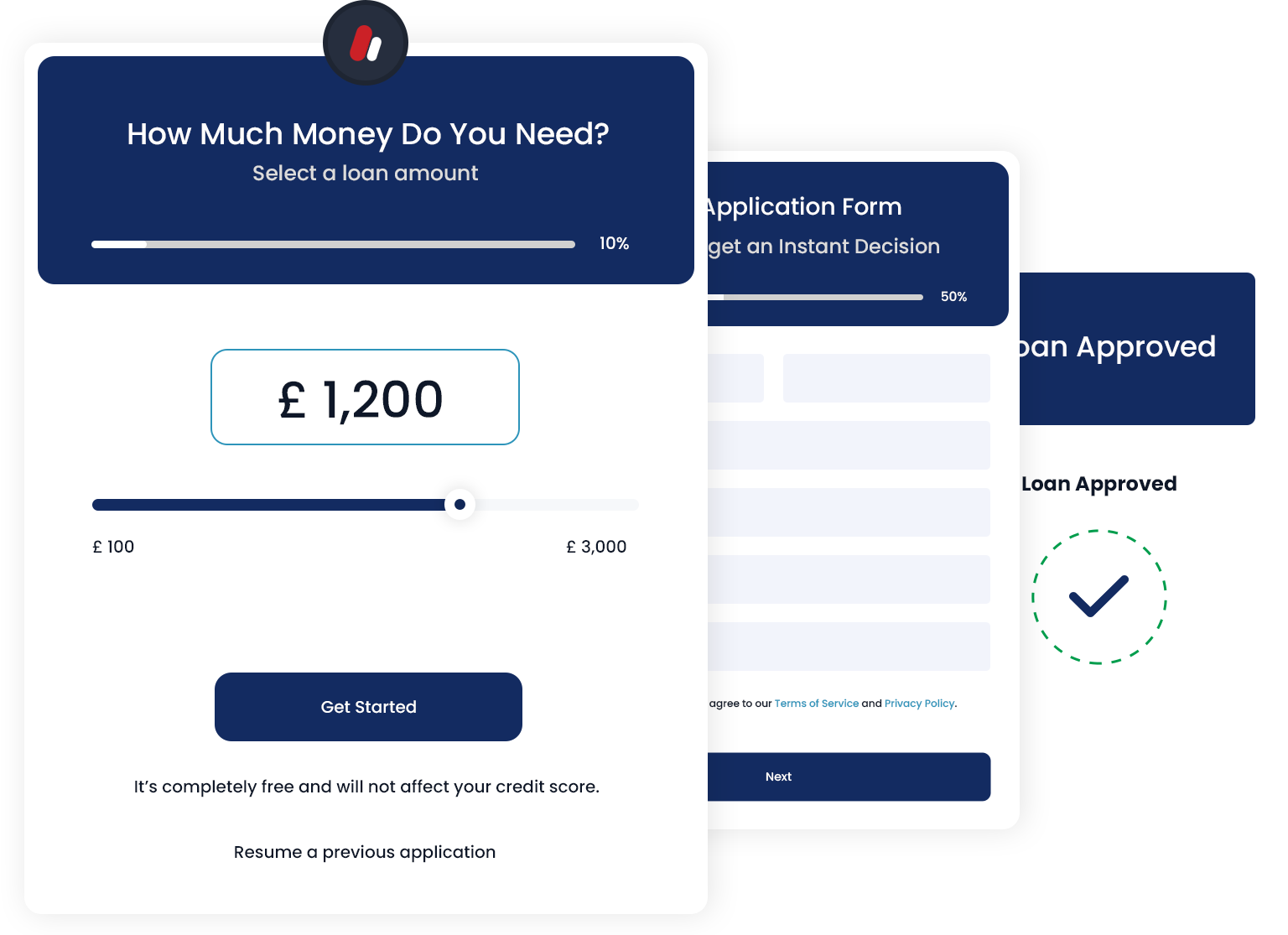

Our AI Lending Technology

Western Circle Group uses cutting-edge AI to revolutionize the lending process, making it faster, safer, and more efficient for everyone.

Our advanced systems analyze data in real time, ensuring quick and accurate decisions for both lenders and borrowers.

With our technology, you get a seamless and transparent lending process tailored to your needs.

Learn More